Quicken Loans, one of the largest mortgage lenders in the United States, has been at the forefront of using modern data warehousing, analytics, and machine learning technologies to enhance its business operations. The company has invested heavily in data analytics to better understand its customers and improve its mortgage origination process. With a focus on innovation, Quicken Loans has been able to maintain its position as a leading mortgage lender in the industry.

Quicken Loans has been using big data and machine learning to improve its mortgage origination process. By analyzing large amounts of data, the company is able to identify patterns and trends that help it make more informed decisions. For example, the company uses machine learning algorithms to analyze customer data to determine the likelihood of default, which helps the company identify high-risk borrowers and mitigate potential losses. Quicken Loans also uses machine learning to analyze credit reports to identify areas where borrowers can improve their credit scores, which can help them qualify for better rates.

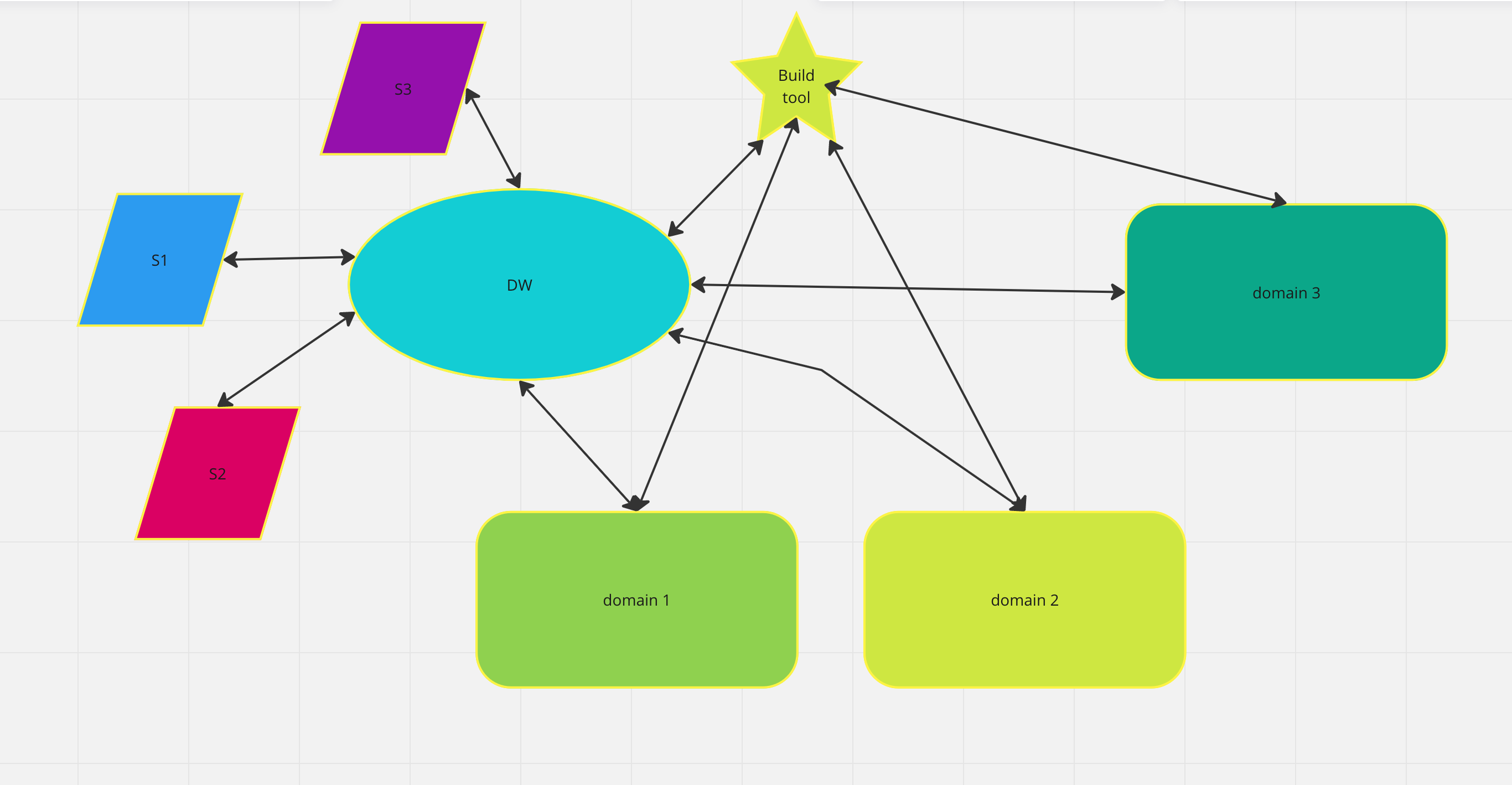

One of Quicken Loans’ key initiatives in the data analytics space is its “Unified Data Platform,” which is a modern data warehousing platform that consolidates all of the company’s data into a single, unified repository. The platform allows Quicken Loans to integrate data from various sources, including its mortgage origination system, customer relationship management system, and other internal and external sources. With a centralized data repository, Quicken Loans is able to easily access and analyze data to gain insights into customer behavior and preferences, as well as track its business operations in real-time.

Quicken Loans has also invested in other data analytics tools to enhance its mortgage origination process. The company uses predictive analytics to identify borrowers who are most likely to refinance their mortgages, which helps it target its marketing efforts and improve customer retention. Quicken Loans also uses natural language processing to analyze customer feedback and identify areas for improvement in its mortgage origination process. These tools have helped Quicken Loans improve its customer experience and increase its customer satisfaction ratings.

In addition to its focus on data analytics, Quicken Loans has also been investing in machine learning to enhance its mortgage origination process. The company has developed machine learning models that can predict the likelihood of a borrower defaulting on their mortgage, which helps it identify high-risk borrowers and take appropriate action. Quicken Loans has also developed machine learning models that can predict the likelihood of a borrower refinancing their mortgage, which helps it tailor its marketing efforts and improve customer retention.

Quicken Loans has made significant investments in its data analytics and machine learning capabilities over the years. In 2018, the company announced plans to invest $1 billion over the next five years to enhance its technology infrastructure, including its data analytics and machine learning capabilities. The company has also acquired several technology companies over the years to strengthen its technology capabilities, including Lendesk, a Canadian mortgage tech startup, and LowerMyBills.com, a provider of mortgage and other financial services.

Quicken Loans’ investment in data analytics and machine learning has paid off in many ways. The company has been able to improve its mortgage origination process and offer more personalized mortgage products to its customers. In 2020, the company funded $145 billion in mortgage volume, a 121% increase from 2019. Quicken Loans also ranked highest in customer satisfaction among primary mortgage lenders in the United States for the 11th consecutive year in 2020, according to J.D. Power.

One of the key success factors for Quicken Loans has been their ability to leverage modern data warehousing, analytics, and machine learning to drive their business decisions. By using big data and analytics to gain insights into customer behavior and preferences, Quicken Loans has been able to personalize their customer interactions, provide better customer service, and develop new products that meet the needs of their customers.

Quicken Loans has invested heavily in their data warehousing and analytics capabilities, with a focus on building a scalable, flexible, and reliable infrastructure that can handle massive amounts of data. They use a combination of proprietary and open-source technologies to collect, store, and process data, including Hadoop, Hive, Spark, and Python. This has enabled them to build a robust and agile data infrastructure that can handle the demands of their growing business.

In addition to investing in their data infrastructure, Quicken Loans has also made significant investments in machine learning and AI. They use machine learning algorithms to analyze customer data and identify patterns and trends that can inform their business decisions. This has enabled them to personalize their customer interactions, provide better customer service, and develop new products that meet the needs of their customers.

Quicken Loans has also used machine learning to improve their risk management capabilities. By analyzing data on borrower behavior, credit scores, and other factors, they can better predict the likelihood of default and adjust their lending practices accordingly. This has helped them to reduce their risk exposure and improve their profitability.

Overall, Quicken Loans has been successful in leveraging modern data warehousing, analytics, and machine learning to drive their business decisions. By investing in their data infrastructure and leveraging cutting-edge technologies, they have been able to gain valuable insights into customer behavior and preferences, improve their risk management capabilities, and develop new products that meet the needs of their customers.

Sources: