Why did the banker go to Better.com? To mortgage his way to a better punchline!

Better.com is a digital mortgage lender that uses modern data warehousing, analytics, and machine learning to streamline the home buying process. The company was founded in 2016 and has since revolutionized the mortgage industry by offering a completely online and transparent mortgage experience. Better.com’s technology-driven approach has enabled the company to disrupt the traditional mortgage lending model and become a major player in the industry.

Better.com’s machine learning capabilities are at the forefront of their operations. The company uses machine learning algorithms to analyze vast amounts of data, including customer data, to better understand their customers and offer personalized loan options. This technology allows Better.com to predict which loan options will be most attractive to individual borrowers, and to offer customized loan terms that fit their specific financial situations. In addition, machine learning algorithms are used to automate various aspects of the loan process, such as underwriting and loan approval, making the process faster and more efficient.

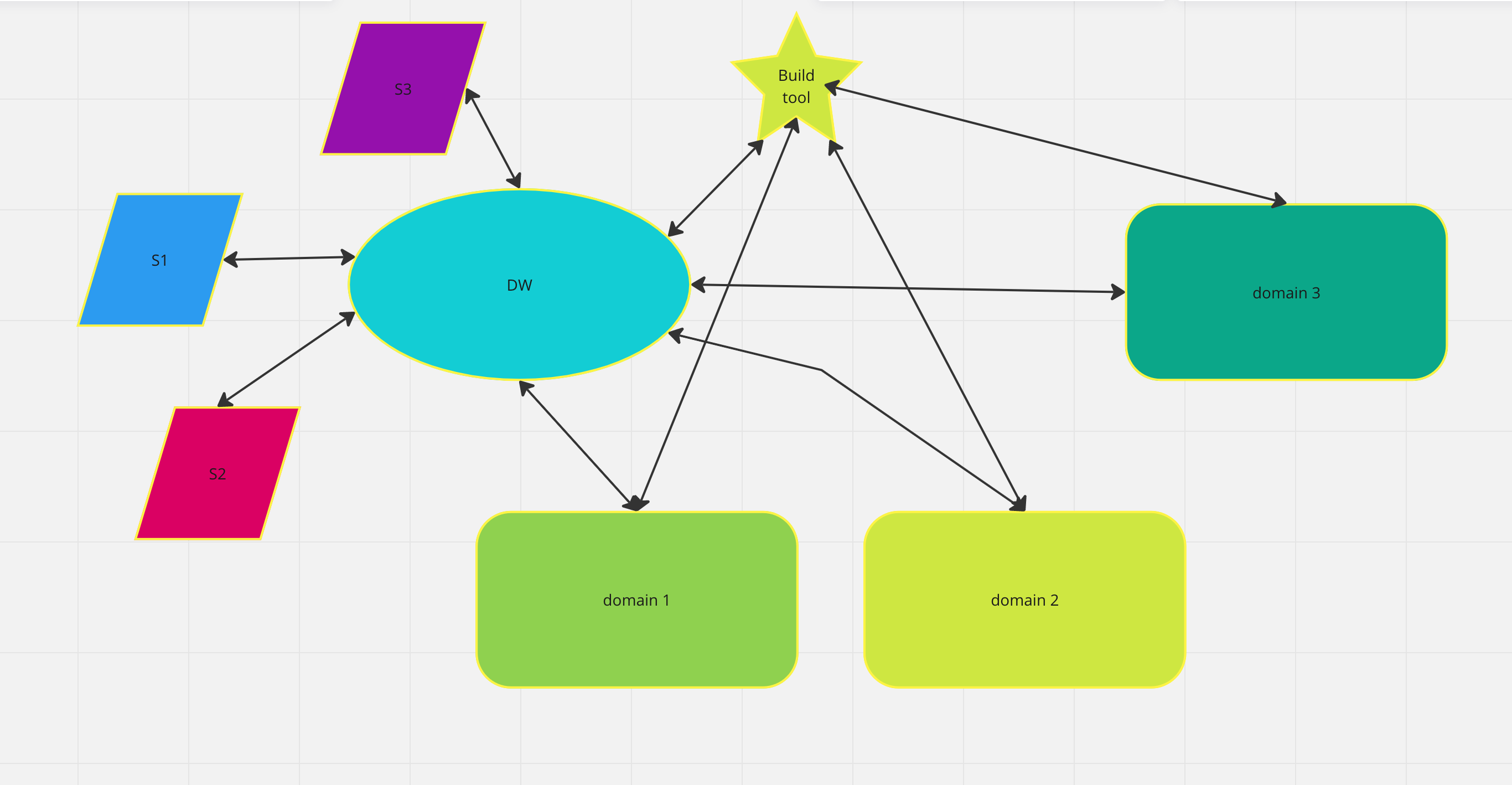

Better.com’s data warehousing capabilities are also a key part of their technology stack. The company uses cloud-based data warehousing solutions to store, manage, and analyze large amounts of data from a variety of sources. By consolidating data from various systems into a centralized data warehouse, Better.com is able to gain a more complete view of their customers and operations. This enables them to make more informed business decisions and to identify opportunities to improve their operations.

To support their machine learning and data warehousing capabilities, Better.com has made significant investments in cloud-based infrastructure. The company uses Amazon Web Services (AWS) as their primary cloud platform, leveraging various AWS services such as Amazon S3, Amazon Redshift, and Amazon EMR. These services provide the scalability, flexibility, and security required to support Better.com’s growing business.

In addition to their technology investments, Better.com has also raised significant amounts of funding to support their growth. The company has raised over $450 million in equity funding to date, and has a valuation of over $4 billion. This funding has enabled Better.com to invest in their technology and infrastructure, as well as to expand their operations and market presence.

In terms of revenue, Better.com is a private company and does not disclose financial information publicly. However, the company has reported that they originated over $24 billion in loans in 2020, a significant increase from the previous year. This growth is a testament to the effectiveness of Better.com’s technology-driven approach and their ability to provide a superior customer experience.

Sources: